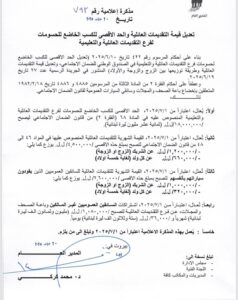

The major clarification we were waiting for was in relation with the Foreign Exchange adjustment of the LBP Devaluation effect on receivables, payables and cash & bank accounts at the opening of the year 2022. The MoF has clarified in the last page of its answers, that the positive differences of exchange up to 15,000 LBP/USD are subject to income tax and the negative differences of exchange can be deducted from the taxable income, while any difference of exchange from 15,000 LBP/USD to 42,000 LBP/USD as at 31 December 2022 and then to 89,500 LBP/USD as at 31 December 2023 are not subject to income tax (i.e. positive and negative differences of exchange should be reverted while transiting from the accounting result to the taxable result).