Catégorie :

MoF answers to the LACPA questions on the Law #330

The major clarification we were waiting for was in relation with the Foreign Exchange adjustment of the LBP Devaluation effect on receivables, payables and cash & bank accounts at the opening of the year 2022. The MoF has clarified in the last page of its answers, that the positive differences of exchange up to 15,000 LBP/USD are subject to income tax and the negative differences of exchange can be deducted from the taxable income, while any difference of exchange from 15,000 LBP/USD to 42,000 LBP/USD as at 31 December 2022 and then to 89,500 LBP/USD as at 31 December 2023 are not subject to income tax (i.e. positive and negative differences of exchange should be reverted while transiting from the accounting result to the taxable result).

MoF decision #583/1 dated 23 June 2025 – Reductions on tax penalties till 30 September 2025

The Ministry of Finance (MoF) decision # 583/1 dated 23 June 2024 (attached a scanned copy) has granted rebates on tax penalties on tax adjustments (whether issued and notified by the MoF or not yet issued) till the 30th September 2025.

MoF decision #582/1 dated 23 June 2025 – Application mechanism for forensic audit on subsidized USD exchange rate

The Ministry of Finance (MoF) decision # 582/1 dated 23 June 2025 (attached a scanned copy) has set the joint mechanism between the Ministry of Justice and the Ministry of Finance in application of the Law # 240 dated 16th July 2021 that imposed an external forensic audit on all the persons that benefited from the subsidized US Dollar exchange rate or its equivalent in Lebanese Pounds.

Decree #422 dated 10 June 2025 increasing the value of the NSSF family allowances

Decree #422 dated 10th June 2025, published in the Official Gazette #27 on the 19th June 2025:

1) The monthly salary ceiling subject to the family allowance of 6% has increased to LBP 18,000,000.

2) The value of the monthly family allowances have increased to a maximum of LBP 4,500,000 being:

a. LBP 1,200,000 for the partner (spouse or husband)

b. and LBP 660,000 for each child (up to maximum 5 children).

This increase will be in force starting from the month that follows its publication in the Official Gazette.

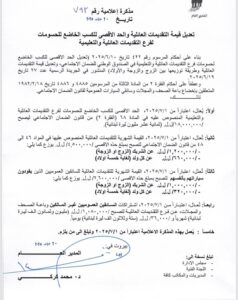

NSSF Notification #793 dated 20 June 2025 specifies that this Decree will be in force starting from the 1st July 2025.

Extension of several tax filling deadlines

MoF decision #545/1: Extension of the deadline for the electronic tax filing of the income from foreign movable assets for the fiscal year 2024 according to the article 82 of the Income Tax Law till the 30th June 2025 inclusive.

MoF decision #546/1: Extension of the deadline for the filling of the annual declaration forms (including the UBO M18 form) for the year 2024 for taxpayers subject to tax on a real profit basis (sole proprietorships, partnerships and institutions who are exempt from income tax and adopting the accrual basis of accounting) and the payment of the related tax as well as for submitting the annual non-resident tax (G5 form) due as per article 41 and 42 of the income tax law till the 29th August 2025 inclusive.

MoF decision #547/1: Extension of the deadline for the annual tax on salaries declarations (R5,R6,R7) of the year 2024 and the payment of the related due tax till the 29th August 2025 inclusive

MoF decision #496/1 on new threshold for Large Taxpayers

The Ministry of Finance (MoF) has issued on the 26th May 2025 the decision # 496/1 (attached a scanned copy) defining the new thresholds to classify a company among the Large Taxpayers that are subject to the control and are monitored by the dedicated Large Taxpayers department at the MoF :

· If its annual turnover in 2022 reached or exceeded LBP 80 billion

· If its annual turnover in 2024 reached or exceeded LBP 400 billion (i.e. around US$ 4,470,000 at the current exchange rate)

If the company’s turnover falls below the above mentioned threshold for 3 consecutive years, it will be excluded from the large taxpayers department at the MoF.

MoF decision #485/1 Extension of Tax on salaries & VAT filling deadlines

Extension of the deadline for the VAT declaration of the 1st quarter of the year 2025 and the payment of the related tax until the 20th June 2025 (inclusive).

MoF decision #484/1 Extension of Tax on salaries & VAT filling deadlines

Extension of the deadline for the VAT declaration of the 4th quarter of the year 2024 and the payment of the related tax until the 20th June 2025 (inclusive).

MoF decision #483/1 Extension of Tax on salaries & VAT filling deadlines

Extension of the deadline for the Tax on salaries declaration of the 1st quarter of the year 2025 and the payment of the related tax until the 16th June 2025 (inclusive).